You are here

Industry Circular 16 of 2025: Registry of Corporate Affairs Update

REGISTRY OF CORPORATE AFFAIRS UPDATE

The BVI Financial Services Commission (the Commission) hereby issues the following update regarding the filing of Beneficial Ownership (BO) information, obtaining certified copies of registers of members, and the restoration of struck off and dissolved companies. Industry practitioners are asked to take note accordingly.

FILING OF BENEFICIAL OWNERSHIP INFORMATION

The function to file BO information will include a dropdown to select the occupation of the Beneficial Owner. See the list of occupations.

When filing BO information in batch or single filing, it is important to note that the data exported from the practitioner’s system in relation to occupation should align with a specific occupation in the dropdown. There is a selection in the dropdown for ‘other’; however, this will not be automatically populated by VIRRGIN if an entry in the spreadsheet does not match one in the dropdown list. Any occupation submitted that is not in the dropdown will result in the batch being rejected; Therefore, if a specified occupation is not on the list, it should be identified as ‘other’.

If industry practitioners are of the opinion that there are additional occupations that should be included in the list, the suggestion should be sent to [email protected] for consideration.

It is anticipated that the function for batch filing of BO information will be available by mid-May 2025.

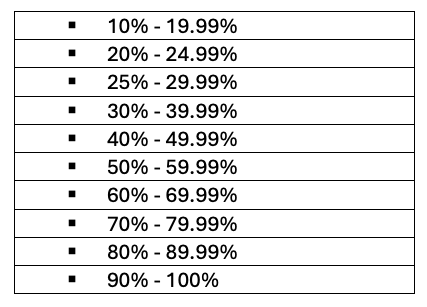

Bands of Percentage Interest for BO Filings

The Commission has considered industry practitioners’ suggestion to implement percentage bands of ownership for (BO) filings. Correspondingly, practitioners have emphasised that minor percentage changes, though often immaterial, can trigger significant administrative costs under the current exact-percentage model. The adopted band approach addresses these concerns and helps to preserve the Territory’s competitive edge in the corporate services market.

Following is a list of the ownership bands which will be recorded on the BO register:

While the Commission acknowledges industry practitioners' preference for alignment with widely recognised reporting frameworks, it has been determined that an alternative approach will be adopted at this stage. This decision reflects the readiness of the chosen method for immediate implementation, helping to avoid any further delays in progressing the regime.

BO Filings for Entities Listed on a Recognised Stock Exchange

The following should be noted when filing BO information for companies listed on a recognised stock exchange:

a) When a BVI business company (itself) is listed on a recognised stock exchange, the exemption option under the registration section is to be utilised.

b) When the BO of a BVI business company is listed on a recognised stock exchange, the BO option under the registration section is to be utilised with the ‘ADD/UPDATE EXEMPTED OWNER’ function.

To avoid issues with filing, agents should carefully evaluate the options above regarding listed companies

REGISTERS OF MEMBERS

Registers of members that were filed publicly can now be requested through the ‘request for certifications’ function in VIRRGIN (stamped or certified copies). These are also available in a company search report.

RESTORATIONS

Industry practitioners are reminded that in accordance with paragraphs 60J, 60K and 60L of the Transitional Provisions to the BVI Business Companies Act (Revised Edition 2020):

a) existing struck off and dissolved companies shall not be restored to the register unless the Registrar is satisfied that the company has filed its register of members, register of directors, and beneficial ownership information, and, if applicable, information on the requirements outlined in sections 118(5) and 118A(1A) or will, within 14 days after restoration make such filing.

b) If the required filings are not made within 14 days, the company will again be struck off and dissolved, and the applicable restoration fees and additional penalties will apply.

The above requirements are to be contrasted with the rules relating to existing companies that have been given six (6) months to file the above-mentioned information in accordance with paragraph 60I. Where necessary, practitioners should refer to the definitions of existing companies and existing struck off and dissolved companies as defined in paragraph 60H.

Queries related to this Industry Circular should be directed to [email protected].